I own a small (1.4 million annual sales) janitorial company that cleans movie theaters. Several of the theaters that I currently work for are beginning to dictate what equipment they will or will not allow in there auditoriums. My fear is that this will pierce the contractor /employer relationship I have with them.

All other aspects of the contractor definition used by the IRS are maintained in this arrangement. The equipment being banned will increase their hours by 20 to 30%. Often they work over 40 hours and I have been paying them a flat rate as contractors all these years.

If I am forced to tell them what equipment is now allowed I will have to change them over to salaried employees. My question is what is the actual minimum amount per hour my costs will be to convert them to salaried employees making over minimum-wage? I know that $7.25 per hour is the minimum wage but how much more does it cost per hour to pay that rate? Social Security and accounting costs run over and above the $7.25 per hour?

Will I be required to pay for their health insurance if they are full-time workers like that? What can I expect in other costs such as recruitment when based on an hourly add on to minimum wage? I'd like to hear your thoughts about what this translates to on a minimum or minimum plus a few dollars per hour wage. If you can direct me to a website that gives me a concise way to compute this that would be greatly appreciated as well. Salary to hourly wage calculator lets you see how much you earn over different periods. It is a flexible tool that allows you to convert your annual remuneration to an hourly paycheck, recalculate monthly wage to hourly rate, weekly rate to a yearly wage, etc.

This salary converter does it all very quickly and easily, saving you time and effort. In the article below, you can find information about salary ranges, a closer look at hourly and annual types of employment, as well as the pros and cons for each of these. Moreover, you can find a step-by-step explanation of how to use this paycheck calculator down below. While salary and wages are important, not all financial benefits from employment come in the form of a paycheck. Use this calculator to help you determine your paycheck for hourly wages.

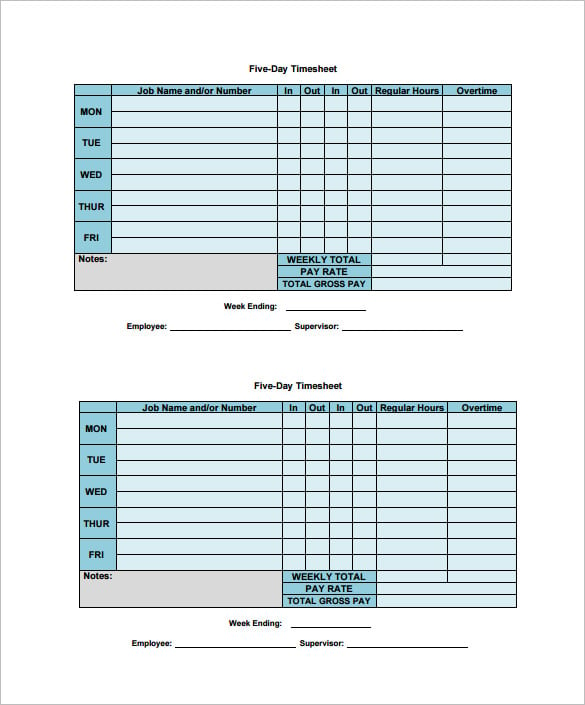

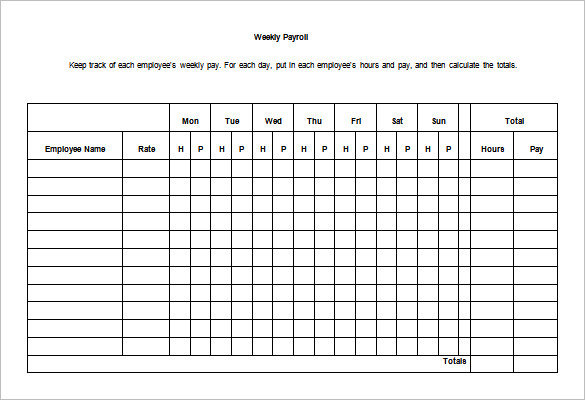

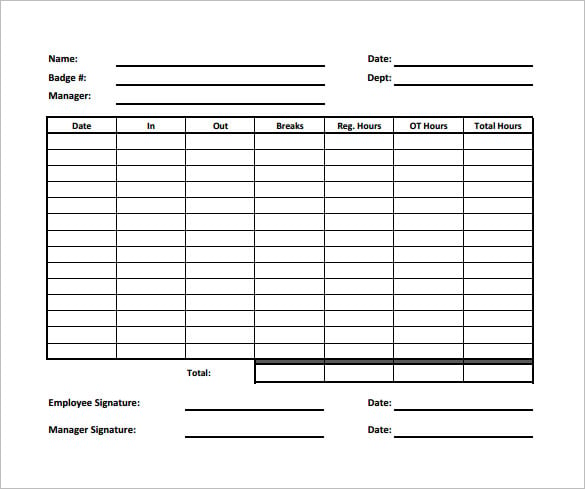

Then enter the hours you expect to work, and how much you are paid. You can enter regular, overtime and one additional hourly rate. If you are paid on an hourly or daily basis, the annual salary calculation does not apply to you. Your bi-weekly pay is calculated by multiplying your daily or hourly rate times the number of days or hours you are paid.

Use our calculator and enter your hourly wages in the Current Salary and set the Pay Period to hourly. Then, input the number of hours you work in the Weekly Hours field. Once you figured out your weekly amount, multiply the total by 52 to get the gross yearly income. Then, divide the number by 12 to get your gross monthly income.

As a simple baseline calculation, let's say you take 2 weeks off each year as unpaid vacation time. Then you would be working 50 weeks of the year, and if you work a typical 40 hours a week, you have a total of 2,000 hours of work each year. In this case, you can quickly compute the hourly wage by dividing the annual salary by 2000.

Your yearly salary of $50,000 is then equivalent to an average hourly wage of$25 per hour. This salary calculator estimates total gross income, which is income before any deductions such as taxes, workers compensation, or other government and employer deductions. To determine your net income, you have to deduct these items from your gross annual salary.

Note that deductions can vary widely by country, state, and employer. When you convert hourly to salary, it's important to consider deductions as well. For example, Sarah works as a Tax Preparer with an hourly rate of $27 and works 35 hours per week. We take her hourly rate of $27 and multiply it by her weekly hours of 35, which gives us $945.

40 Hour Work Week Salary Calculator Then, we'll multiply $945 by 52 to get the annual salary of $49,140. We'll then divide $49,140 by 12, which gives us a $4095 gross monthly income. Were you offered a new job opportunity and want to derive the prospective hourly wage from the offered annual salary?

Just like in the last example, you need to know exactly how many hours you'll have to work per week at your new job. If you don't, the average full-time employee works 40-hours per week , and we can use that as a baseline for our calculations. To determine your hourly wage, divide your annual salary by 2,080. The hourly to salary calculator converts an hourly wage to annual salary — or the other way around. As an employer, use this calculator to help determine the annual cost of raising an hourly rate, or how hourly workers' overhead business expenses on an annual basis.

In Florida, overtime hours are any hours over 40 worked in a single week. Federal labor law requires overtime hours be paid at 1.5 times the normal hourly rate. Enter any overtime hours you worked during the wage period you are referencing to calculate your total overtime pay. The Fair Labor Standards Act, passed in 1938, guarantees employees compensation at one and a half times their regular rate for hours worked above 40 hours per week. How overtime is calculated depends on whether the employee is paid hourly or by salary. Further, the calculation for salaried employees differs depending on the number of hours per week the salary is meant to compensate for.

For example, if you're getting paid $20 per hour and work 40 hours per week, your gross weekly paycheck is $800. You now multiply this by 52, which shows an annual gross income of $41,600. Alternatively, you can simply multiply your weekly sum by four. In the U.S., according to the payment rules regulated by the Fair Labour Standards, salary workers are not covered by overtime . It is worth mentioning, that in many countries companies offer their workers various kind of compensations for overtime hours.

That might be just additional money, time off adequate to the number of overtime hours, or other benefits. When a salaried employee is classified as non-exempt under Fair Labour Standards, an employer has to pay one and a half for each extra hour over standard 40 per week. To avoid misunderstandings, clear all your doubts in your state's Department of Labour or your country's labour law. You will see the hourly wage, weekly wage, monthly wage, and annual salary, based on the amount given and its pay frequency. Please note this is based on a 40 hour work week with 52 weeks per year and 12 months per year.

Any wage or salary amount calculated here is the gross income. There are several reasons why you might need to convert an employee to a salaried job. If you engage the services of an independent contractor to employee status, you want to consider what you are currently paying the consultant per hour, so you can determine an annual salary. Or, if you have a part-time employee moving to a full-time, salaried position, you should first consider the part-timer's hourly rate, so that you can calculate the employee's new salaried amount. If you know the reasonable hourly rate for your employee, it's simple to calculate an annual salary. This type of calculation is especially helpful when you are converting an hourly wage earner to a salaried position.

It's also helpful when you are considering transitioning an independent contractor – typically paid by the hour – to a salaried position with your company. For example, a school teacher works a 10-month position during the year but gets paid biweekly even over the summer. You get a paycheck every couple of weeks and tax forms at the end of the year. Freelancers' earnings are usually based on hourly or daily rates though, sometimes, they are based on weekly or monthly payments.

And since working as a freelancer doesn't come with the many benefits that full-time employees enjoy, their pay must be higher than what full-time employees would relatively earn. In our contemporary supply-demand-driven environment, however, we often see that the rates are under pressure. • Input your hourly wage, normal hours per week, overtime hours, and no. of weeks worked in a year to determine weekly and annual salary.

Take, for example, a salaried employee who is paid $500 in salary for a 50-hour workweek and works a 50-hour week. However, the Overtime Hours—the hours between 40 and 50—have already been compensated by the salary. In effect, the employee has been paid $10/hour for those Overtime Hours. Thus, in calculating the overtime pay cannot be calculated by multiplying the Regular Rate by 1.5 because the employee has already received part of what he is entitled to. The straight calculation of hourly pay to annual pay is, therefore 2,080 hours multiplied by the employee's hourly rate.

For example, an employee who earns $25.00 an hour and who works 20 hours per week, earns $26,000 annually. Converting that part-time employee to a full-time salaried position at the same hourly rate would mean that you pay her $52,000 annually, which is $25.00 an hour for 2,080 hours worked per year. As an example, a part-time employee who earns $50.00 an hour, might not receive the same hourly rate in a full-time, salaried position because the employer has to cover benefits costs. It's imperative that you review the Fair Labor Standards Act whenever you convert an hourly employee to salaried pay. There are federal laws that govern the classification of salaried employees.

Use SalaryBot's salary calculator to work out tax, deductions and allowances on your wage. The results are broken down into yearly, monthly, weekly, daily and hourly wages. In the U.S., salaried employees are also often known as exempt employees, according to the Fair Labor Standards Act . This means that they are exempt from minimum wage, overtime regulations, and certain rights and protections that are normally only granted to non-exempt employees. To be considered exempt in the U.S., employees must make at least $684 per week (or $35,568 annually), receive a salary, and perform job responsibilities as defined by the FLSA.

Certain jobs are specifically excluded from FLSA regulations, including many agricultural workers and truck drivers, but the majority of workers will be classified as either exempt or non-exempt. Assuming that the employee actually is converting from a 20-hour week to a 40-hour week, you can essentially double what she is currently making to arrive at an annual salary. For clarification, however, 1,040 is the total number of hours this part-time employee works during the year. For full-time employees, the annual number of hours is 2,080 – 52 weeks multiplied by 40 hours each week. To calculate hourly rate from annual salary, divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week. If you wanted to be even more accurate, you can count the exact number of working days this year.

It has a total of 365 days in the year including both weekdays and weekends. So if you worked a normal 8 hour day on every weekday, and didn't work any overtime on the weekends, you would have worked a total of 2,080 hours over the 2022 year. You can then convert your annual salary to an hourly wage of roughly$24.04 per hour. Enter your current payroll information and deductions, then enter the hours you expect to work, and how much you are paid. You can enter regular, overtime and an additional hourly rate if you work a second job. This calculator uses the 2019 withholding schedules, rules and rates .

Historically the most common work schedule for employees across the United States is an 8-hour day with 5-days per week. This salary calculator can be used to estimate your annual salary equivalent based on the wage or rate you are paid per hour. Follow the instructions below to convert hourly to annual income and determine your salary on a yearly basis. This is your annual salary based on your hourly wage and the number of hours you are paid for each week (weekly pay times 52.14 weeks per year). To calculate your annual salary from your biweekly income, you must first multiply your biweekly wage by the number of weeks you work. If you don't have any weeks off at the end of the year, you'll generally multiply your wages by 26.

There are 52 weeks in a year, so you'll divide this by 2 to get your biweekly pay periods. So, for example, if you do have two unpaid weeks, take one biweekly pay period off from the resulting number. For example, Brad works at Target for 40 hours per week, but clocks out for 35 minutes for his lunch break, so he'll only get paid for 36 hours per week. To calculate the hourly wage, you want to multiply the hours you've worked by your hourly wage. Then multiply that with the number of weeks in a year, which is 52.

If Brad makes $15 per hour and works 36 hours per week, his annual salary is $28,080. A Salary Calculator is a tool that can help you determine your hourly, monthly, annual, semi-monthly, weekly, and bi-weekly pay with your current salary. You can use this information to negotiate a pay raise with your employer or decide if another job offer is worth it. Below, we're going to give you a breakdown of how our salary calculator works and the ways you can use it to determine your prospective paycheck. How do I calculate the hourly rate of an employee based on annual salary?

Simply enter the hourly rate and the number of hours per week into the calculator below. If needed, modify the number of weeks worked for more accurate results. One of the hourly-employee benefits is that your hours maybe more flexible - no 9 to 5, 5 days a week. That provides more freedom and can lead to better time management. On the other hand, while your weekly shifts are very irregular, it might be frustrating because you feel disorganized. Let's consider some pros and cons of both types of employment.

As it usual when comparing two things, we have both pros and cons for each of them. For example, if you are a monthly salary employee, you can count on more social benefits, like health insurance, parental leave, a 401 plan and free tickets to cultural institutions. For sure, full-time jobs consume much more of your time, the level of responsibility is higher, but they offer a possibility to develop your career.

What might be motivating is a feeling of stability, thanks to the same amount of money you receive every month. One of the crucial drawbacks of that kind of work might be not being paid for overtime, meaning you will not be compensated for any extra activities . When talking about payments in specific job positions, we often use the term salary range.

In fact, the meaning is depending on if you are an individual or a company's financiers. From an employee's viewpoint, salary range includes compensation parameters, such as overtime, as well as including benefits, like a company car or health insurance. On the other hand, for the company, it will be the amount that it is able to pay a new employee for a particular position and how much current employees can expect to earn in that specific position. Usually, companies cannot make exceptions from the salary ranges, because the numbers are strictly determined by its budget. If you do any overtime, enter the number of hours you do each month and the rate you get paid at - for example, if you did 10 extra hours each month at time-and-a-half, you would enter "10 @ 1.5".